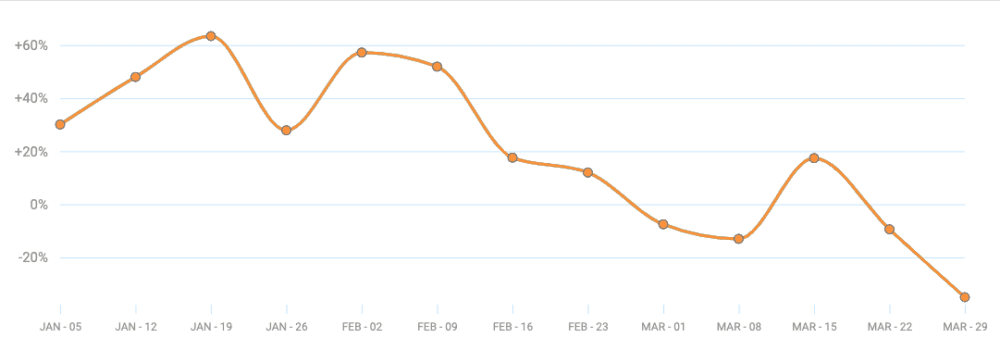

The last three months have seen a dramatic drop in purchases from Italian fashion retailers online, but the country’s fashion brands seem to be over the worst. That’s according to new data from ccinsight.org, the daily Covid-19 Commerce tracker from data technology firm Emarsys.

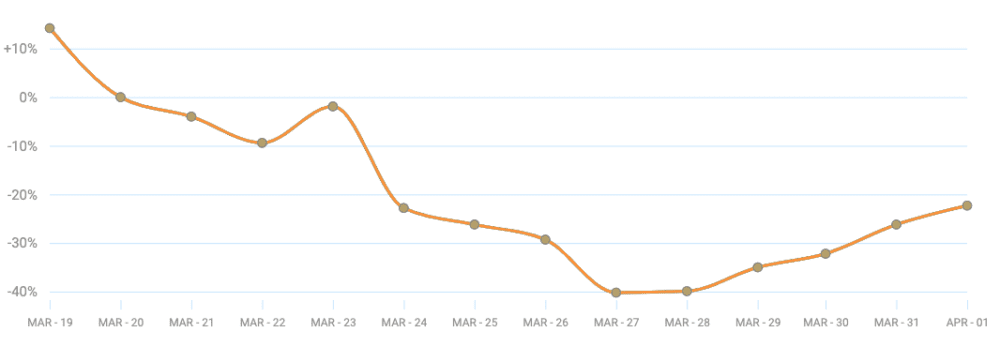

Over the last two months of the crisis, ccinsight has recorded a 40% drop in ecommerce fashion orders across Italian brands. Revenue from the fashion and accessories segment was also reported to have dropped by 26% over this period.

Following this collapse, which peaked in late March, ccinsight has been reporting a slow but steady recovery across the Italian fashion sector. Since 28th March, data has shown a steady climb in orders of 18% and an increase in revenue of 13%. Among the fashion items seeing a wider global uplift right now are luxury goods such as handbags and trainers, along with gloves and sportswear.

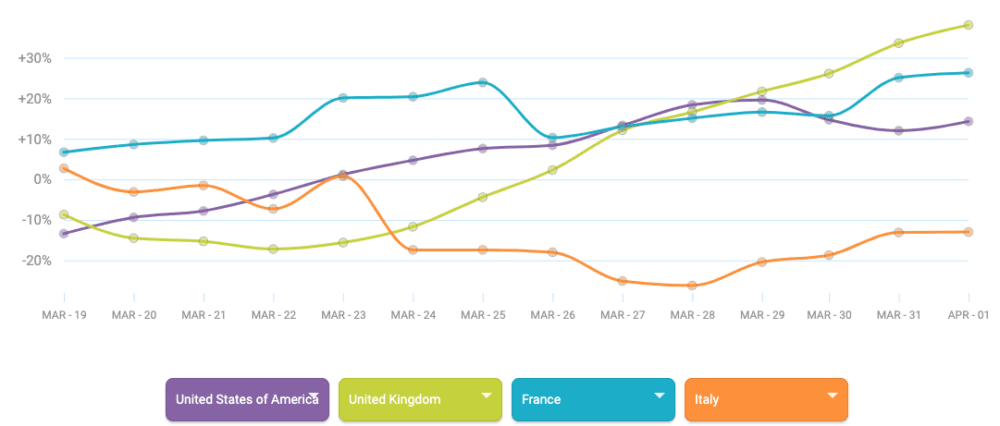

While this is good progress for the fashion industry, the sector is still significantly down compared to pre-Coronavirus levels. According to ccinsight, this also leaves Italy’s fashion industry in bad shape compared to those of other nations impacted by the crisis.

Alex Timlin, senior vice president of verticals at Emarsys, who has been analysing the data said: “Italy is a world leader in fashion, and as such it’s no surprise that the industry has been hit hard by the recent lockdown — even online.

“Now, as consumer confidence grows, we are starting to see a steady recovery in the Italian fashion market. Brands that would have sold in-store are also switching online, with ecommerce orders back on the rise. If this trend continues it could be good news for the Italian economy, but there’s still a very long way to go before the market gets back on its feet.”

These online trends were identified by Covid-19 Commerce Insight a joint project between leading customer engagement platform provider Emarsys and data analytics provider GoodData showing the impact the impact of Covid-19 on consumer confidence.

The tool used by Emarsys to identify these trends draws on more than a billion engagements and 400 million transactions in 120 countries, providing a global and regional picture of ecommerce activity and trends — a key indicator of overall economic conditions in these unprecedented times.

Key insights from Covid-19 Commerce Insight include how the pandemic is affecting the number of online consumer transactions, order numbers, the average order value, types of items purchased and more — in any industry and region in the world — in context of the extraordinary measures taken by governments globally.