UK retailers are at the sharp end of rapid digital transformation as they race to keep pace with shifting customer demands but many of the UK’s leading brands are struggling to adapt, according to groundbreaking new research.

The study conducted by Vanson Bourne on behalf of digital product consultancy Elsewhen looked at digital progression through the lens of 200 UK decision-makers, including retail leaders.

Over two-thirds (67%) of respondents in the retail sector work for companies that generate a global annual revenue of between £1bn and £10bn, 46% work with an annual IT budget of between £5m and £10m, and 49% come from organisations with 5,000+ employees.

Yet, despite these considerable resources, the study found that:

-

93% of retail decision-makers say there is “vast” or “significant” room for improvement in projects that focused on bringing new digital products and/or services to market

-

82% believe that their organisations need guidance in measuring how well digital transformation projects are going

-

79% point to big gaps between digital strategy and what can actually be achieved (significantly higher than the study’s overall cross-industry figure of 64%)

-

67% think that their organisation lacks a clear digital strategy

This knowledge gap may be caused by failure to define a suitable digital vision.

Survey findings showed that retail sector organisations are relatively unlikely to include a definition of the digital vision in their digital strategy (31% compared to 52% overall).

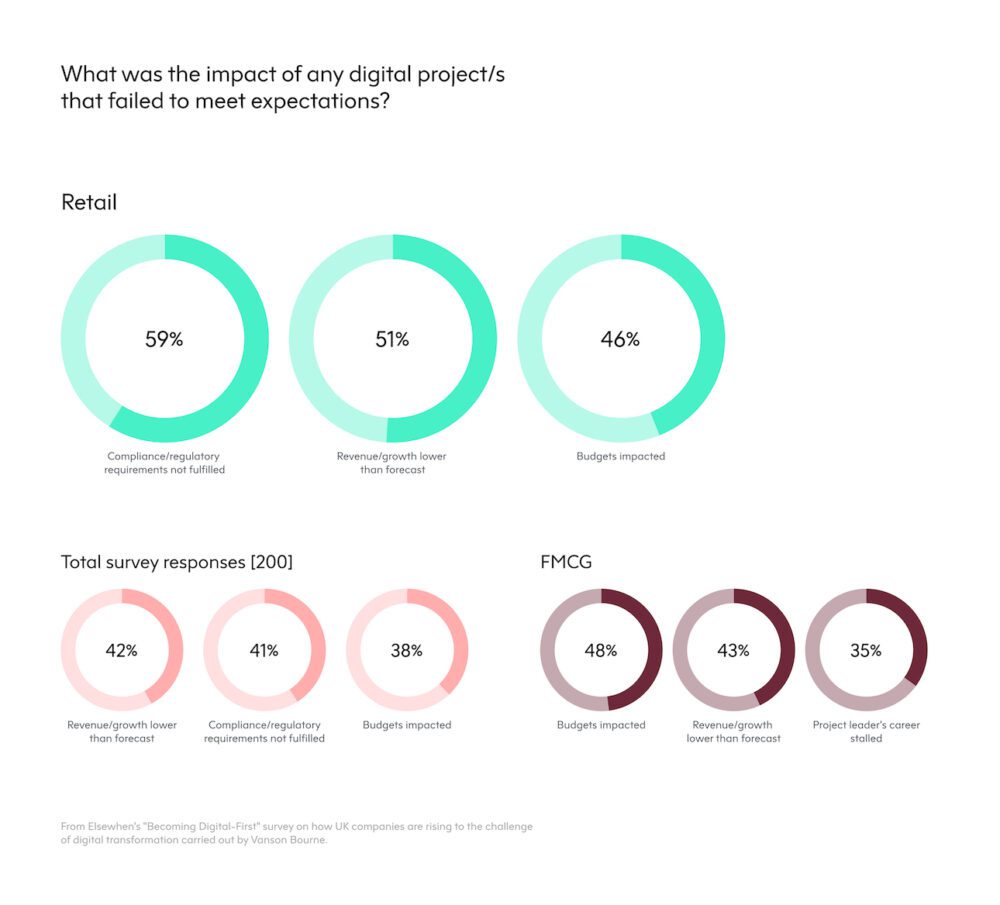

Automation, AI/ machine learning and green energy are all key areas of focus for retailers when it comes to the technologies driving digital transformation. Yet 77% of those questioned claim that their senior leadership team does not understand how to use emerging tech such as AI and machine learning to benefit their business compared to the overall study average of 60%. This gap in understanding has implications for the bottom line, with 51% of retail leaders blaming failed digital projects for lowered revenue/growth. Overall, retail leaders reported experiencing greater negative effects of failed digital projects than other sectors, citing delayed new project launches, organisational clashes, and impact on budget as just some of the consequences of project failures.

Retailers are not alone in their struggle, either. The study – which also canvassed decision-makers in FMCG and financial services, among others – reveals a series of endemic management, tech and operational issues in digital transformation that extended across all markets.

The problem is particularly acute within IT teams for all industries spotlighted by the study. A striking 89% of IT leaders questioned in the survey work in companies with an annual IT budget of £1m+. And yet a third cite a lack of leadership experience in product (34%) and nearly a quarter cite a lack of leadership experience in technology (23%) as their top strategic concerns.

In more positive findings, the results indicate that retailers are putting employee engagement front and centre of their existing digital projects, with improved employee experience (64%) trumping even improved customer experience (56%) as the overall goal of digital projects in the past 12 months.

Commenting on the results, Elsewhen co-founder and chief product & strategy officer Leon Gauhman said:

“Retail is in the eye of the storm when it comes to digital transformation. This new data highlights the constant pressure retailers face to adopt new processes and technologies in order to keep pace with accelerating customer demand.”

“Historically, retail’s approach to digital has been “too little too late.” To break this cycle retailers have to shift from a reactive mindset to develop proactive, meaningful strategies that define their vision for their customers. We are not talking about blue sky thinking, but strategy driven by realistic insights into what customers want and where technology is going next.”

Consultancy may have a powerful role to play here, with an impressive 100% of survey respondents across all sectors describing their most recent third-party project as either meeting (45%) or exceeding (56%) expectations. Longer-term relationships work better, however. Overall the survey found that companies that rely on third-party digital services more than half the time are significantly more likely to say that the most recent digital project exceeded expectations (65%) compared to those who use the same services in half or fewer digital projects (46%).

“Retailers have powerful assets such as their relationship with the customer, access to huge quantities of customer data, plus they have amazing products,” says Gauhman. “Securing the expertise of a trusted partner could help optimise these assets, ensuring they continue to successfully evolve their offer to keep pace with constantly changing customer expectations and technology.”

The survey was conducted by research firm Vanson Bourne on behalf of Elsewhen in Q3 2022.

Study background

Elsewhen’s survey canvassed 200 decision-makers at major UK companies across multiple sectors (including FMCG, retail and financial services sectors) in Q3 2022. Over 60% of respondents work at businesses with 5000 or more employees, and 39% work at companies in the 1000-4999 employees bracket

The influence of these companies is underlined by the size of their IT budgets. 89% of those surveyed work at companies where the annual IT budget exceeds £1m. More than a third (37%) are working with IT budgets that exceed £10 million per annum. In terms of overall global revenues, 86% of decision-makers interviewed in the study work at corporations generating more than £1bn per annum. The smallest 3% of company employees quizzed in the survey have revenues of £300-500m.