Shop prices continued to fall in March as the third consecutive month of lockdown led many retailers into heavy discounting, figures show.

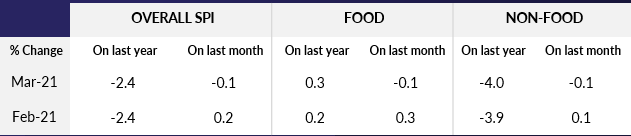

Overall prices fell by 2.4%, the same rate of decline as in February and below the 12 and six-month average decreases of 1.8% and 2% respectively, according to the BRC-Nielsen Shop Price Index.

Prices of fashion and footwear have now seen double digit declines in 11 of the past 12 months, highlighting how the worst-hit retailers have been working hard to tempt consumer spending.

Non-food prices saw their fastest rate of decline since May last year at 4%, compared with 3.9% in February and below the 12 and six month average declines of 3.5% and 3.5%.

Food inflation inched up to 0.3% from 0.2% in February but prices remain significantly below long-term averages, while fresh food prices fell for the fourth consecutive month at a steady rate of 0.8%.

British Retail Consortium chief executive Helen Dickinson said: “Low demand and intense competition online will help thrifty consumers find the bargains they are looking for.

“Unfortunately, many retailers may not be able to sustain these low prices in the coming months. Rising global food prices, at their highest since 2014, as well as increased oil prices and shipping costs, and Brexit red tape will likely begin to filter through, pushing up prices at tills.

“Government must ensure that new checks and documentation requirements this autumn avoid introducing significant friction on the import of goods, otherwise British consumers will end up paying the price.”

Mike Watkins, head of retailer and business insight at Nielsen, said: “With consumer spend limited by pandemic restrictions, non-food retailers are keeping any supply side driven price increases to a minimum and in some cases are reducing prices, to encourage shoppers to maintain spending in the run-up to Easter.

“Whilst food retailers have seen top-line sales grow at around 9% since the start of the year, we are now lapping the extreme comparatives of March last year and shop price inflation in food still remains very low and less than CPI.”