Price comparison group Moneysupermarket.com has agreed to buy cashback business Quidco in a deal worth up to £101 million.

Moneysupermarket said it will pay £87 million in cash with a further £14 million deferred under the deal to snap up Maple Syrup Media, trading as Quidco.

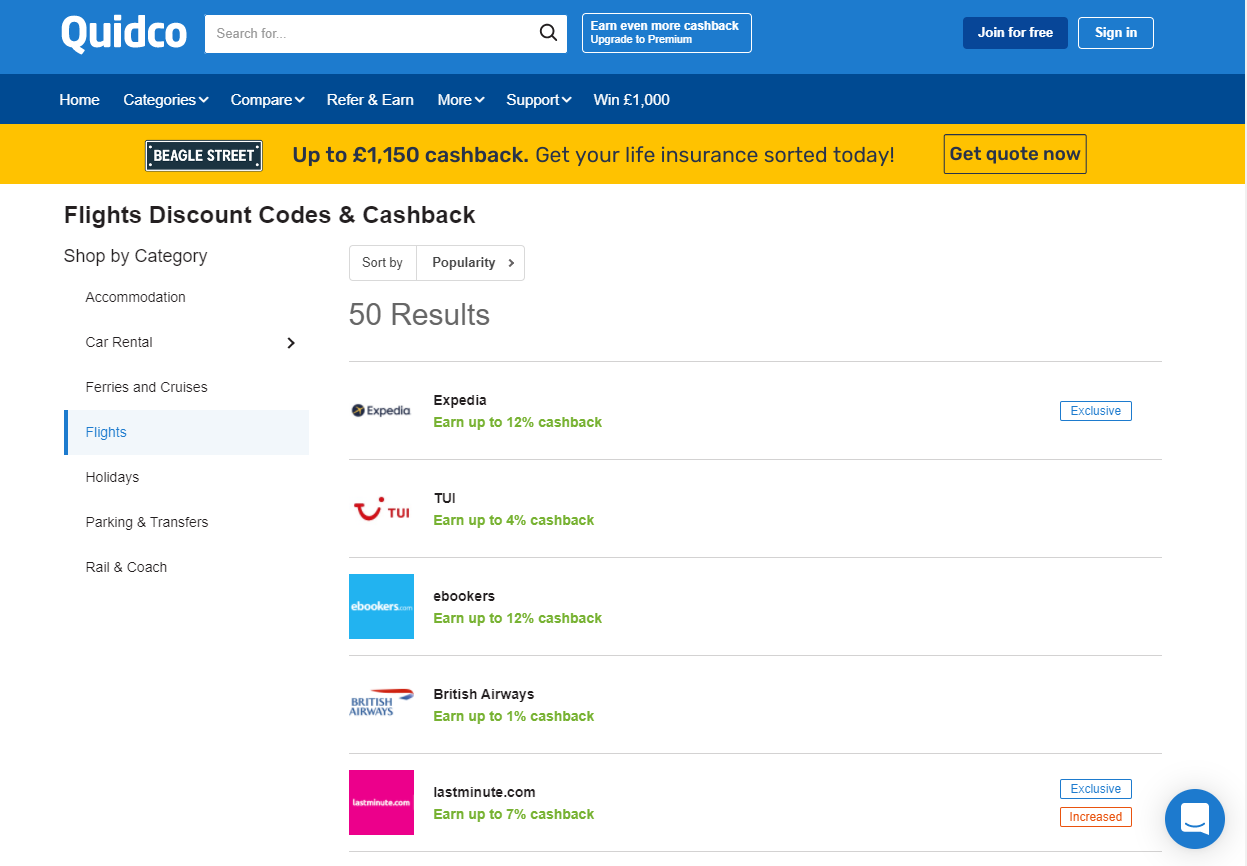

Quidco is the second largest cashback business in the UK, with around one million members.

It offers cashback at about 4,500 sellers, including retail, travel and switching services.

Moneysupermarket said it hopes Quidco will benefit from its data and technology platform, as well as capabilities such as data analytics, search engine optimisation expertise and customer relationship management.

It aims to “expand and deploy” Quidco’s capabilities into other group brands.

For Quidco’s members, Moneysupermarket said they should, over time, benefit from improvements to the site and overall user experience.

Quidco saw underlying earnings grow “significantly” to £7.9 million in the year to July 31, on revenues of £59.2 million, according to Moneysupermarket.

Details of the takeover came as Moneysupermarket cautioned over the impact of soaring energy prices in its latest trading update.

The firm saw energy market woes send its home services revenues plunging 46% to £13.9 million in the third quarter, though this was partially offset by a robust quarter for revenues across its money and travel businesses.

Overall group revenues fell 10% in the quarter to £76.4 million.

The firm said it expects to see further “negligible” gas and electricity switching over the fourth quarter – a market that accounted for 16% of group revenues at the end of last year.

Moneysupermarket said: “In July and August, wholesale energy prices continued to rise steeply, keeping customer savings at unattractively low (and often negative) levels.

“The further substantial increases in wholesale prices from mid-September led to providers removing tariffs from the market, and negligible energy switching.”

It added: “We do not anticipate energy market conditions will improve this year and therefore expect that switching will be negligible in the fourth quarter.”