Consumer electronics brands are looking to increase their direct-to-consumer selling in 2023, despite the cost of living crisis and reductions in consumer spending. In addition, they are looking to broaden their use of social channels to include Instagram Checkout and TikTok in equivalent volumes to Amazon, new research shows.

This finding comes from ChannelAdvisor, a CommerceHub company, which conducted a survey of C-suite employees at large consumer electronics brands (with over 500 employees). The research polled 300 decision makers with a responsibility for sales or marketing and found a surprisingly high number are utilising additional channels alongside Amazon.

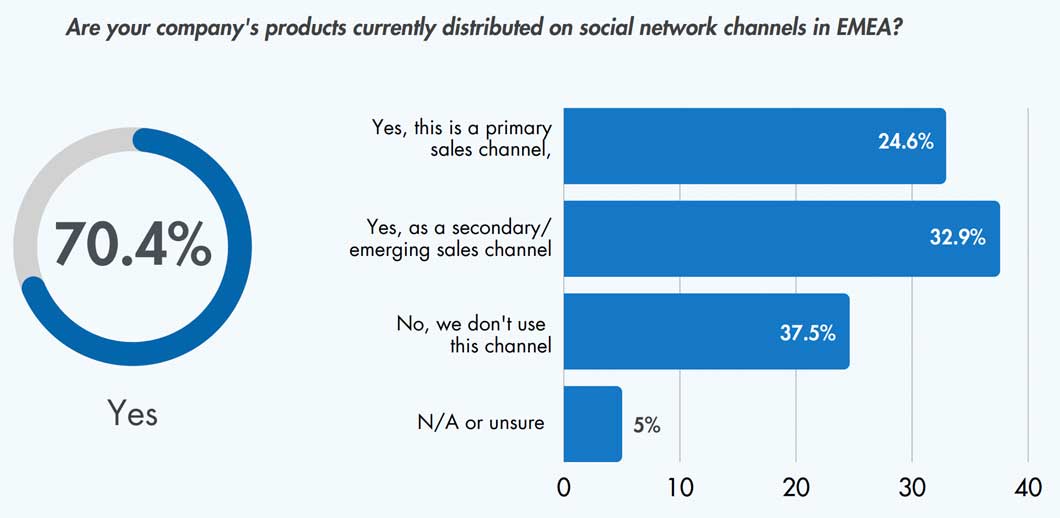

Amazon has been a mainstay for consumer electronics brands and 69% of those surveyed claimed it is still a key channel. However, when looking at the most popular distribution channels, it’s clear to see that brands are diversifying to new areas alongside Amazon. 71% are distributing via other online marketplaces like eBay and John Lewis, and 70% are now incorporating social media into their selling channel strategy.

Alongside the expansion of channels comes the challenge of ensuring consistency across them and the survey demonstrated this is an area that businesses struggle with. Two-thirds (65%) of respondents agreed they found it ‘difficult’ to achieve consistent product information across sales channels. When asked why consistency was hard to achieve, three-quarters of those surveyed flagged the ‘different requirements’ for product information.

“Amazon has long been the top dog for selling consumer electronics, but these latest results show brands are harnessing the power of social media as well,” Vladi Shlesman, Managing Director, EMEA at ChannelAdvisor, a CommerceHub company, commented. “The stats will provide plenty of food for thought for Twitter’s new owner, Elon Musk, as Twitter is one of the few social platforms not to offer a direct sales option.

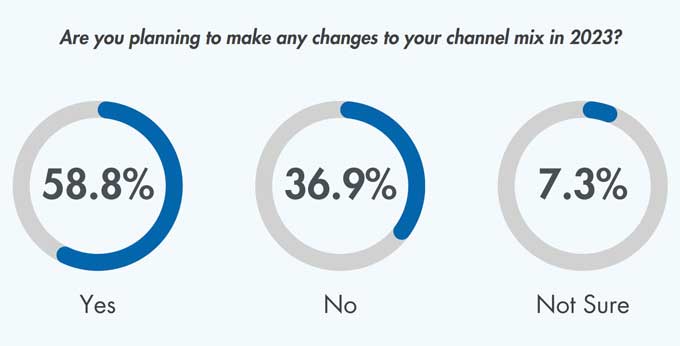

“Consumer electronics brands need to be selling where their consumers are buying, and with so many options, a multi-channel strategy is inevitable. However this can bring complexity and challenges with consistency, both in terms of product information and brand experience. It’s also more important than ever for brands to think carefully about their channel strategy to ensure that they focus on channels that are profitable.

“Brands embracing direct-to-consumer channels is not a new phenomenon, but the expertise to achieve a seamless experience is often underestimated. Businesses should look to partner with industry experts and leading technology to get their offering right and ensure consistency across platforms.”

Grey market sellers are also a significant challenge for consumer electronic brands, with over half (55%) of those surveyed claiming they were ‘having issues’ with unauthorised grey market sellers. Often these grey market sellers acquire inventory from leaks in sales channels, for instance distributors offloading excess stock.

“The best option for brands struggling with grey market sellers is to target the source,” Shlesman added. “Monitor third-party sellers on marketplaces to determine which ones are authorised and which are grey market. Then try to shut down their inventory source. You should also monitor to determine the performance of product listings and then competitively tune pricing, using the analytics tech.”

Returns are another area of concern for consumer electronics brands, with half (52%) of all respondents claiming that returns ‘were a problem’ for the business. Those who are having issues with returns expressed that it is having a ‘significant impact’ on the company.

For more statistics from the survey, download the report here.

CommerceHub and ChannelAdvisor enable over 18,000 retailers and brands to reach and convert more shoppers, expand their margins, and enhance the online shopping experience through drop ship, marketplace, digital advertising, and delivery management. With a significantly expanded network and portfolio of SaaS products and services, their solutions enable networked commerce to make it easier for businesses to list, find and sell millions of products every day.

Survey Methodology

The research was conducted by Censuswide with 301 CMO or Chief e-commerce officers from electronic brands who are decision makers of marketing or e-commerce. Aged 25+ in company size of over 500 employees between 09.11.2022 – 23.11.2022. Censuswide abide by and employ members of the Market Research Society which is based on the ESOMAR principles and are members of The British Polling Council.

For more information visit ChannelAdvisor’s blog, follow ChannelAdvisor on Twitter @ChannelAdvisor, like ChannelAdvisor on Facebook and connect with ChannelAdvisor on LinkedIn.