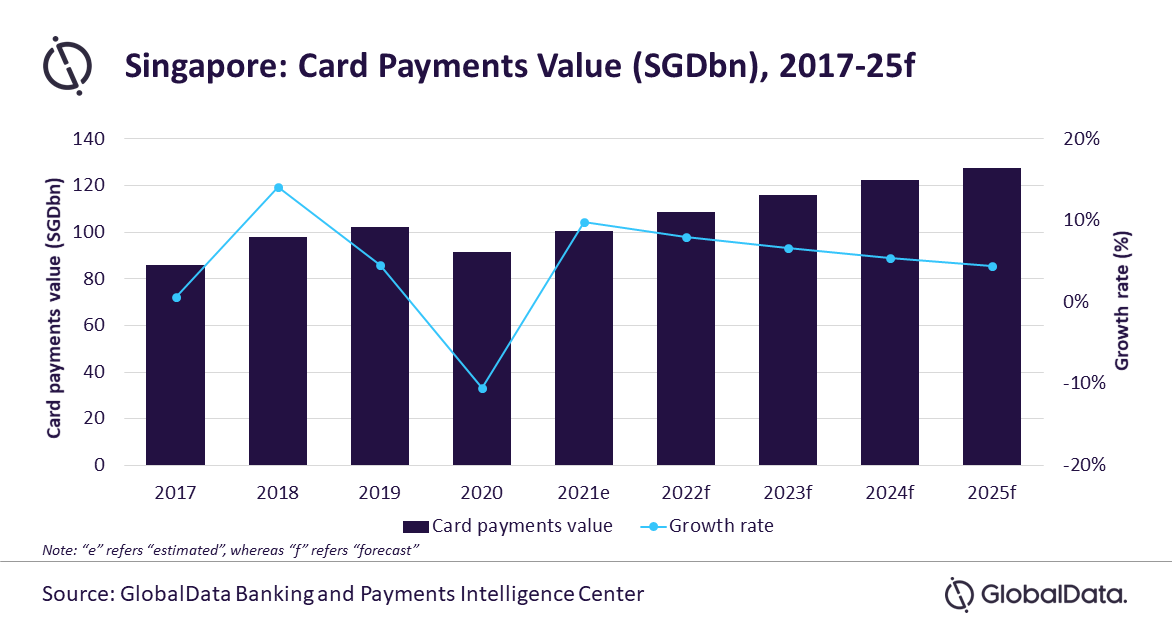

Card payments in Singapore are set to rebound with 8% growth in 2022, with improving economic conditions, forecasts GlobalData, a leading data and analytics company.

Singapore was among the first countries to be affected by the COVID-19 pandemic. This caused significant economic disruption, with GDP contracting by 5.4% in 2020 – its first annual contraction since 2001. However, there has been gradual economic recovery with GDP growing by 6.9% in 2021, supported by government’s stimulus program and nationwide vaccination rollout.

According to GlobalData’s Payment Cards Analytics, the value of card payments in Singapore declined by 10.5% in 2020. However, with gradual recovery in economy, card payments are expected to rebound strongly in 2021 with an estimated 9.9% growth to reach S$100.6bn ($76.1bn). The value is anticipated to grow further at a compound annual growth rate (CAGR) of 6.1% between 2021-2025 to reach S$127.6bn ($96.6bn) in 2025.

🏆

The 2024 Creative Retail Awards are open for entries.

The Creative Retail Awards are much more than a mere accolade; they represent the pinnacle of achievement in the retail industry. Garnering a nomination or winning one of these awards is a testament to innovation, excellence, and leadership.

www.creativeretailawards.com

Singapore has made significant progress towards becoming a less-cash society in the last few years, supported by high banked population and consumer awareness of electronic payments.

Growth in card payments is supported by its large card acceptance network, with almost six point of sale (POS) terminals for every 100 individuals in 2021. This is much higher compared to its peers including Australia (3.7), New Zealand (3.6), China (2.8), Hong Kong (2.5), Japan (1.9), and Taiwan (0.5).

Nikhil Reddy, Senior Analyst at GlobalData, comments: “Singapore has a developed payment card market with high degree of usage and penetration. While the COVID-19 pandemic and the uncertainty associated with it impacted card payments, the resumption of business activities and revival in consumer spending helped card payments recovery.”

While the pandemic has affected consumer spending, it highlighted the importance of non-cash payments among Singapore consumers as electronic payments are more effective in avoiding physical contact while making payments. Consumers are gradually moving away from cash to electronic payments including card payments.

Contactless card payments are expected to be a key growth driver as consumers favour contactless cards for low-value transactions instead of cash. To promote the use of contactless payments, in December 2021, the Land Transport Authority, under the Ministry of Transport in Singapore announced to phase out traditional paper tickets at MRT stations by end of March 2022 and allow payments only via digital modes such as contactless payment cards and mobile wallets. This will further benefit card payments growth.

Reddy concludes: “Singapore’s card payments market is well developed, supported by high consumer preference for electronic payments, and robust payments infrastructure. Although card payments market was affected by the pandemic, the market swiftly rebounded and is anticipated to continue its uptrend, supported by revival in economic conditions.”